The internet has changed every aspect of our lives, including how we do banking. In extremely rare scenarios, you need to visit the bank since all the banking services are now available at the click of a button.

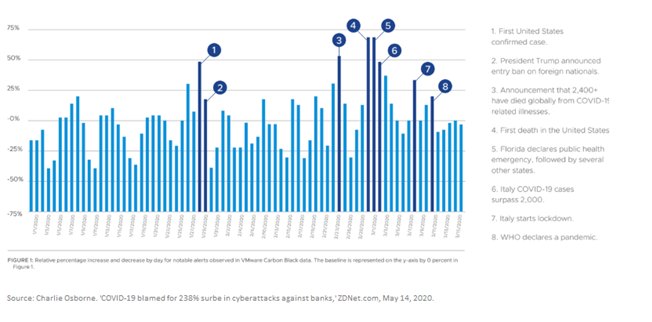

The rise in online banking has also resulted in an increase in cyber security attacks on banks. As per reports[1], there has been a whopping 238 percent increase in cyber security attacks on banks. The increase was majorly seen after the COVID-19 crisis struck the entire world.

Though banking organizations leave no stone unturned to remain secure, still financial services account for close to 35 percent[2] of all data breaches. What we are referring to is just the tip of the iceberg, since banks and other financial institutions need to increase their investments on strengthening their security. These collective steps would ensure that the data is less vulnerable to cyber attacks (and cyber frauds).

Below are the million-dollar questions:

- How can banks and other financial institutions minimize the threats of cyber attacks?

- Is there a possibility to eliminate cyber attacks?

CIOs (Chief Information Officers) should consider security testing on priority, since the bank’s data, customer’s confidential information, and the institution’s reputation is at stake. In this blog, we look at how various aspects of security testing are helping make financial institutions more safe & secure.

Top Security Threats To Financial Institutions

The financial services industry (predominantly banking) is looming large with a range of security threats. Heavens will break loose if hackers get hold of the customer data and vital information related to the bank! Partnering with a proven security testing company like KiwiQA should be considered in case the institution does not have in-house expertise with security testing.

Here are the top security threats being faced by the financial services industry (as a whole):

DDoS (distributed denial-of-service) Attacks

DDoS attacks slow down the performance of the website, thereby making it partially (or completely) unavailable for the end-users. DDoS protection tools can come in handy in such scenarios since they keep the site protected from such malicious attacks.

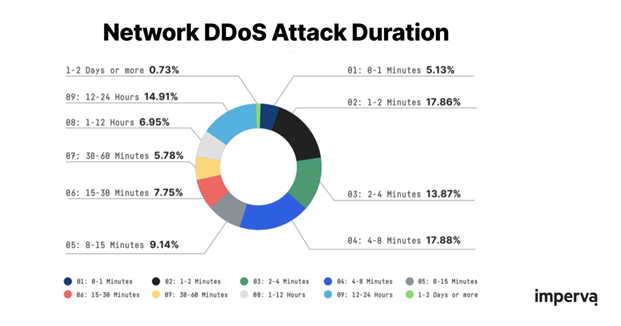

The frequency of DDoS attacks is witnessing slow growth in 2021, with the median duration of the attacks hovering around 6.1 minutes[3]. However, banks have to be vigilant of DDoS attacks since they can damage the reputation of the bank.

Reputation-based blocking tools can be helpful in identifying malicious URLs and establishing a database for protecting against future attacks.

Web Application Attacks

All the web applications that use the HTTP protocol use port 80, whereas HTTPS-based applications use port 443. Banking customers should first check if the website is using the HTTPS protocol else their data is not secure.

CIOs should ensure that their team does a regular checkup of the database(s) and fix vulnerabilities (if any) so that it is not exploited by the hacker community.

Also Read – 7 Web Application Security Best Practices

Insider Threats

Though there should be a focus on avoiding external threats, there should be an increased focus on securing the threats from malicious members within the organization. As per reports, close to 60 percent of cyber attacks[4] come from inside the company.

Bank tellers, disgruntled employees, and other malicious actors could act as a spoil-sport for the financial institution. Banks need to tighten the control and ensure that valuable information cannot be taken for malicious purposes.

Phishing scams, human errors, and malware downloads should be kept in check so that the reputation of the bank and customer’s data is not at stake. An experienced security testing services company like KiwiQA can help fix such loopholes, thereby ensuring that the banking website (and app) is free from all types of malicious attacks.

Emerging Technologies

We are living in a technologically connected world where things are becoming more connected as well as de-centralized than ever before. Banks are increasingly making use of technologies like IoT (Internet of Things), Blockchain, wearable technologies, etc. to provide multiple digital touchpoints to the end-customers.

This convenience can also open up new avenues to the malicious actors where they can exploit the security loopholes in the respective application (IoT, blockchain, etc.). Blockchain testing and IoT testing can be significantly useful in such scenarios since they can help in fixing the vulnerabilities in the system.

Also Read – Myths and Facts of Security Testing

Apart from these major security threats, banks (and other financial institutions) should also address the following threats:

- Backdoors And Supply-Chain Attacks

- Third-party (and beyond) party vendor Attacks

- Global penetration risks

Top Application Security Testing Tools

Irrespective of the size or scale of the security threat, banks should consider all of them as a top priority. At the end of the day, the reputation of the financial institution will get tarnished if it experiences any security threat!

Here are the top application security testing tools that can be used for addressing security threats faced by banks:

Static Analysis Tools

Akin to static code analyzers, static security tools help in analyzing and scrutinizing the patterns and detecting the vulnerabilities in the source code. It also sends an alert to the developer whenever there is any security issue with the source code.

Dynamic Analysis Tools

In contrast to static analysis tools, dynamic analysis tools take a regular dump of the commonly-known security vulnerabilities to ensure that the application (or software) is free from vulnerabilities.

Interactive Analysis Tools

Here, the code library is triggered at regular intervals for creating a more secure version of the application (or software). This category of tool is majorly used for detecting any behavioral-related issues (or vulnerabilities) in the banking product.

Also Read – Your Guide To Mobile Application Security Testing

Best Practices of Security Testing in Banking Industry

Though there are several mechanisms to test the security-related aspects of the application, here are some of the best-known practices for testing the application (or software) from a security perspective:

Don A Hacker’s Hat

Hackers are always on the lookout for exploiting vulnerabilities in banking software so that they can make quick bucks from the same. Hence, security tester(s) needs to don a hacker’s thinking hat to check for unexpected patterns (or behavior) in the banking application (or website).

Thorough Testing of External Interfaces

Many banks are now leveraging the benefits of the hybrid cloud approach since it helps reduce the infrastructure costs, without compromising on the data integrity (and security) aspects.

However, APIs and public interfaces can be a potential exploit point since there are interactions with cloud-based infrastructure. External interfaces when hacked can leak secure information of the bank (as well as its customers).

Security teams in banks should consider API security testing on priority so that banks can maximize the benefits offered by hybrid cloud technology.

Also Read – Security Testing Best Practices

Implement Data Loss Prevention (DLP) Strategies

Security testing should incorporate front-end testing as well as back-end testing so that potential vulnerabilities can be fixed before the application is live on the production environment. Testing should be performed on the staging environment so that a top-notch application (or software) can be pushed to the production server.

Data Loss Prevention (DLP) should be a part of the security testing strategy to ensure that the end-users do not share any sensitive information outside the corporate network. A range of DLP software(s) can be used for ensuring that confidential customer data (and other relevant information) is not accessible to the unintended (or malicious) audience.

Conclusion

Banks across the world (including those in emerging economies) are witnessing a digital transformation. Though this has brought increased convenience to the end-users, it has also resulted in an increase in the intensity of security threats.

Hence, it is important for banks to address security-related loopholes on priority so that their customers can truly enjoy a frictionless and highly secure banking experience. Banking institutions can also take support from proven companies like KiwiQA that have expertise in the security testing services sector.